Dissertation Sample: Impact of FII in Indian Stock Market

- 3 December 2024

- Posted by: OAH

- Category: Dissertation

This is a dissertation sample work on the impact of foreign institutional investments On the Indian stock market. This sample dissertation will help students in understanding how to write a dissertation. This management sample dissertation also showcases the high-quality dissertation writing help we provide to students worldwide.

Understanding the dissertation structure, different chapters and their meanings, and the work flow in a systemic order is crucial for writing a good dissertation. The following dissertation sample will help you in discovering it all.

Need Dissertation Writing Help? Contact us for Complete Dissertation Help Online!

IMPACT OF FOREIGN INSTITUTIONAL INVESTMENTS IN INDIAN STOCK MARKET

Declaration

I, ________________________, hereby declare that this is an unique work of mine. Any university or institution would not be permitted to access this project for any course of them. Additionally, all the references have been used properly in the literature review part.

Abstract

This dissertation has focused on the impact of Foreign Institutional Investment in the stock market of India. The researcher has divided the overall project in five separate chapters. The first chapter is all about to introduce the project. It has included the research questions and objectives. Research aim has also been added there. Other than that a brief description of Indian Stock Market has also been included in this chapter. The dissertation structure which has been mentioned in this chapter has provided a basic concept about the project at a glance.

The second chapter is all about the literature part. The researcher has discussed all the secondary data here. References from various scholars have been added in this chapter to enhance the authenticity of it. Besides that, addition of conceptual framework would provide a basic knowledge about the fact discussed in the chapter. Other than that, the researcher has identified a gap in earlier researches, based on which this project has been composed. In third chapter, the researcher has discussed about the overall methodology part. It has included the research philosophy, design, approach, sample size and so on. Post-positivism philosophy has been chosen and deductive approach has been used here. Other than that, descriptive design has also been selected by the researcher. Total sample size were 50 and 2. Quantitative questions were asked to the 50 traders and 2 managers of SEBI have been interviewed by the qualitative questions.

Apart from that, in fourth chapter, the researcher has discussed all the primary data and the fifth chapter was dedicated for concluding the overall project. In addition, the recommendations for identified issues have also been narrated here. In addition, some other points like objective linking, future scope and limitation so study have made the project more valuable. Acknowledgement

I would like to thank to the people without whom I would not be able to complete this project.

First, I would like to give thanks to my friends and family who supported well throughout my studies. Special thanks and gratitude to my Supervisor who guided me and resolve all my problems.

Other than that, I am thankful to the respondents as well.

Yours thankful

…………………..

Glossary

| Term | Definition |

| FIIs | The institution established outside the India, proposes to make investment here. |

| Market size | It is a measurement that includes the total volume of a global market. |

| SEBI | The Securities and Exchange Board of India is a regulatory for security markets in India |

Chapter 1: Introduction

1.1 Introduction

The foreign institutional investment (FII) can be defined as the institution which has been organized outside the India. The main purpose of FII is to make investment into the security market of India under the SEBI regulation. It includes mutual funds, asset management company, foreign pension funds, nominee company, investment trust, institutional portfolio manager, bank, foundations, university funds, endowments, charitable societies, charitable funds, power of attorney or trustee may establish outside the India. It would propose to make proprietary investments. Even, it can invest on the behalf of broad-based fund as well. Thus this research has chosen FII as the topic of the research. This chapter is one of the most important parts of the dissertation as it discusses about the reason based on which the project has been conducted. For providing some practical examples and to relate to this investment Indian Stock Market has been chosen.

1.2 Background of the Research

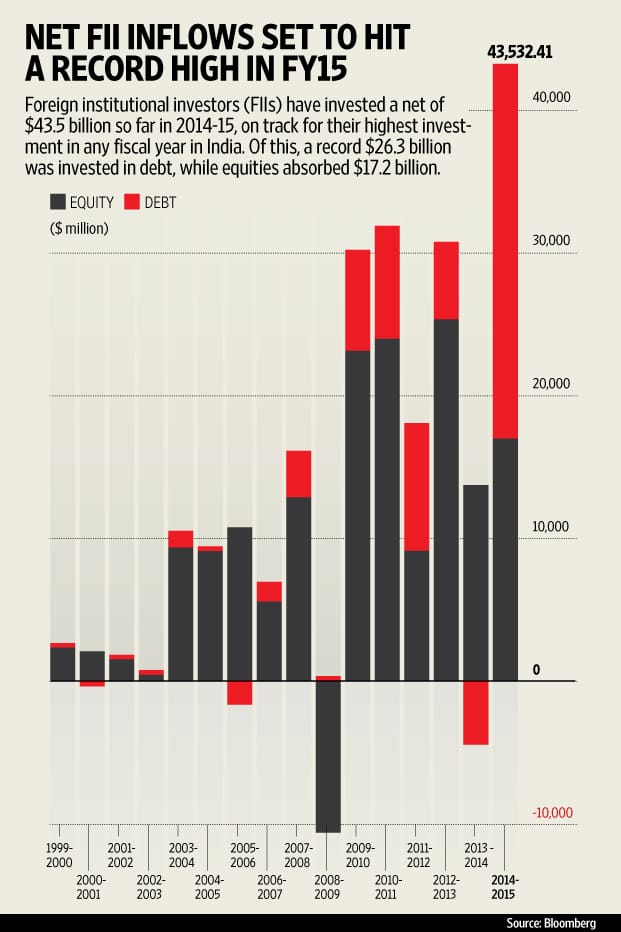

Figure 1: Existence of FIIs in India

(Source: Dhingra et al. 2016)

Vardhan and Sinha (2016) have commented that FII has the opportunity for investing in the own funds and the investment can be applied for the foreign clients too. Institutional investors would have major influence in corporation management. It was September 1992, when FII has got permission to be implemented in India. After that until the end of March 2012, 1765 FIIs have been registered by SEBI. The above showed picture is depicting that FII has stirred the Indian economy. Therefore, the current mechanism of Indian stock market also needs to be changed due to the changing financial scenario. It is being considered as a primary concern of stock market and that is why discussion on implementation of FIIs is highly required.

Background of the Company

National Stock Exchange of India Ltd (NSE) and Bombay Stock Exchange (BSE) have jointly formed the Indian Stock Market. The open electronic limit order book is required to continuing the trading of these two exchanges. The trading computer matches the order for both the exchanges in the purpose of continuing their trading. Most of the significant companies in India have been enlisted in both the exchanges. NSE holds 70% of market share through spot trading. Even, it has held a monopoly grasp in derivatives trading as well. They have 98% share in this market (Agarwal, 2016). It has been pointed out that BSE holds almost 4700 firms in their list whereas NSE has nearly 1200 firms in their list (Mishra and Zaveri, 2017).

1.3 Rationale of the Research

What is the issue?

The primary issue of this research work is to identify the effectiveness of FII in the stock market of India. Jalota (2017) has stated that the external and domestic financial conditions are not the factors that have motivated the contribution of FIIs. Yet, the short-run expectations have also been shaped through it and it is named as the market sentiment. The factors of high mobility and speculation in the investment of FII can maximize the volatility in developing market during the stock return. Therefore, it is required to unveil the importance of FII investment as the people can get a proper understanding of it.

Why it is an issue?

Several practitioners and academicians have held a wide perception that about the emerging equity market that the return or price in such markets are very frequent in extended deviations from the fundamental values along with the subsequent reversals. Therefore, these swings should be in a large part as it has the influence of foreign capital. Kumar (2017) has added that volatility indicates a chaotic situation that can limit the FII contribution. It would affect the stock market of India in a large aspect. That is why, discussing the impact of FII on Indian stock market is highly required. This turmoil has made it a big issue for the financial organizations.

Why it is an issue now?

According to Malhotra and Chauhan (2017), volatility discourages the investors to hold stocks because of the rising uncertainty. In addition, the weak and ineffective regulatory system of ‘emerging market economies’ may decrease the market efficiency as well. All of them together is basically reducing the effectiveness of FII. However, the researcher has identified that it may create a major problem in this regard. Thus, it becomes the issue now and focusing on it is one of the most essential tasks in recent time.

What could the researcher shed light on?

The researcher may discuss on the effectiveness of FII and the way by which maximum benefits of FII can be availed. Dhingra et al. (2016) have added that trading through FII should be happen through a continuous and uninterrupted process, thus the local stock markets can avail its benefits. The financial organizations may need to take full benefits of FIIs in their businesses. Hence, this research may focus on the importance of FIIs, which would emphasize the benefits of it as well.

1.4 Problem Statement

In spite of contributing several positive factors in Indian economy, it has been noticed that some financial agencies are still unaware of the necessity as well as usefulness of it. The researcher has identified it as a major problem of current time. Thus, composing this research was very essential as with the analysis of FII’s effects, people may come to know about its usefulness too.

1.5 Research Aim

The research aims to identify the impact of foreign institutional investment on the stock market of India.

1.6 Research Objectives

The research objectives are:

- To assess current changes in the Indian economy for which India has become an attractive destination for FIIs

- To critically evaluate the impact of FIIs on the Indian economy and Stock Market

- To determine the issues faced by FIIs while investing in Indian Stock Market

- To assess the effectiveness of the Indian Stock Market with respect to FIIs

- To recommend some ways by which the Indian Stock Market supports FIIs

1.7 Research Questions

The research questions are:

- What are the recent changes in the economic structure of India which make the country suitable for FIIS?

- What is the impact of FIIs in Indian economy and Stock Market?

- What are the issues faced by FIIs while investing in Indian Stock Market?

- What is the effectiveness of Indian Stock Market in respect to FIIs?

- What are the recommendations for Indian Stock Market to adopt FII?

1.8 Significance of the Research

This study is signifying the effect of foreign institutional investment on the Indian stock market. Vardhan and Sinha (2016) have opined that FDI or Foreign Direct Investment is not sufficient enough for several multilateral institutions of finance. This is the reason for which involvement of FII is required. It reduces the capital cost and can be accessed through cheap credit. Therefore, in current turmoil of world economy, FII is playing a significant role to boost up the economic engagements. Hence, discussing on this topic would be the most significant and relevant now.

1.9 Dissertation Structure

Figure 2: Dissertation structure

(Source: Created by author)

The researcher has described the overall structure of the dissertation here. This structure is as follows:

Chapter 1: Introduction- This is the first chapter of the dissertation. This chapter has provided an elaborate view of the overall project. The reason behind choosing the particular research topic has also been mentioned here. In addition, the aim, objectives, and research questions have been included in this chapter as well.

Chapter 2: Literature review- This part of the dissertation has focused on the previous literatures those have been developed by earlier researchers on similar topic. This chapter helps the researcher in gathering several related data. These data has highly helpful for the researcher to develop this project. It includes various theories related to the research topic as well.

Chapter 3: Research methodology- This is one of the most important parts of a research project as this chapter determines the method based on which the overall research may be conducted in an effective way. This chapter includes research onion, design, approach, data collection process, data analysis techniques and so on.

Chapter 4: Data analysis and findings- This chapter is completely dedicated to analyze the collected data. This chapter is highly significant in this project as it may help the researcher to draw the ultimate conclusion for this research.

Chapter 5: Conclusion and recommendation- This is the last chapter of a dissertation. The author has added the overall conclusion of the collected data here. Apart from the conclusion part, it has included the objective linking, future scope and limitation of the research as well. The key factor of this part is the recommendations. It has developed by the researcher to resolve the identified loopholes related to the research topic.

1.10 Summary

This is the introductory part of a research work, thus it is being considered as the most important part of a project. The significance of choosing this topic has included in this chapter. On other way, it is better to say that this chapter may help to identify the importance of chosen topic and overall dissertation at a glance. Besides that, inclusion of research rationale would provide a better understanding about the identified issue in this project. It includes four sub-parts and each of the parts has proved the significance of selecting this issue gradually in a step by step process.

Chapter 2: Literature Review

2.1 Introduction

Literature review is known as the evaluative report which has been formed after analyzing the literature related to the research topic. A literature review is a part of the paper for academic purposes that contain the knowledge about the topic along with the substantive findings that the author comes up with while doing the research work (Talib et al. 2012). It can be said that the Literature Review is a methodological as well as a theoretical contribution to the topic in concern. However, it must also be taken into consideration that literature review is not the report of the original experiment work. It should be a descriptive, clear, evaluative and summarised review of related literature. This chapter has provided an overview of Indian economy along with the description of current changes of it. Other than that, explanation regarding Indian stock market, strengths and weaknesses of FII, its effect on Indian stock market has also been included here. Apart from that the researcher has analyzed the gap found in earlier literature too. Basically, this chapter would provide a complete concept about Indian Stock Market and the present scenario of Indian economy.

2.2 Discussing the Overview and Current Changes in the Indian Economy

Proper understanding of the economy in India is best way to compose this research in a right way. Economy is related to everything and proper knowledge in it means to consider things in a larger perspective. The economy of India is a very mixed economy as well as a developing one. The economy of India is the sixth largest economy by nominal GDP, and by PPP or Purchasing Power Parity, the country’s economy ranks at third biggest. As per the reports of 2016 by per capita nominal GDP, India has a rank of 141 with $1723 (Binswanger-Mkhize 2013). Again, India is at the 123rd position by per capita PPP GDP with $6616 (Agrawal 2015). By the year 2017, the Indian Economy became the world’s fastest-growing which even had surpassed China. Srinivas (2016) has mentioned about three sectors in Indian economy. They are primary, secondary and tertiary. The primary sector is related to agriculture, which is one of the most common and important activity for the people in India. The secondary sector indicates to the industries. In addition, the tertiary sector is all about the service related activity. These three sectors are the main sources by which the economy of India is earning maximum profits.

The researcher has taken a note to the history of Indian economy where the First Plan has been found to be don between 1951 to 1956. It was a total budget of Rs. 2069 crore at that time. Yet it was increased later on and becomes 2378 crore (Kumaraswamy et al. 2012). That plan has divided money for each of the department like energy and irrigation has got 27.2%, community development and agriculture was being allotted by 17.4%, communication and transport have got 24%, industry was being allotted for 8.4%, 16.64% was allotted for the social services, 4.1% was being invested for the land rehabilitation and other sectors as well as services have got 2.5% (Binswanger-Mkhize, 2013).

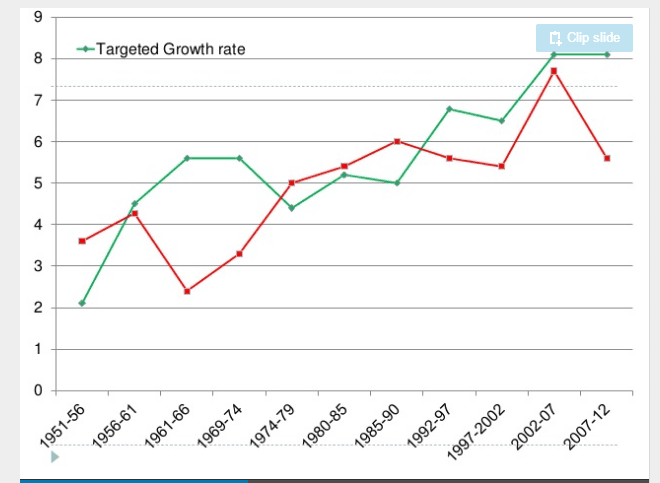

Figure 3: Targeted growth rate of Indian economy

(Source: Goldar and Goldar, 2016)

According to (Boutabba, 2014), in the first plan the target GDP growth was about 2.1% per year. On the other hand, the achieved growth rate has become 3.6%. The time validity of a financial plan is five years. Therefore, till the present year 12 plans have been made by the government. This twelfth plan has been made in 2012 and would be validate till 2017. This plan has decided about the growth rate of 8.2%. The current government is intended in the reduction of poverty up to 10% during this plan (Hudson.org. 2017). Therefore, it can be said that Indian economy is growing fast and it is expected that the plan would be successful very soon.

The market size of the Indian economy:

As stated by Ahmad et al. (2016), India is being considered as the fastest growing economy. Both the International Monetary Fund (IMF) and Central Statistics Organisation (CSO) have declared that Indian economy has changed and developed rapidly in comparison to other emerging countries. It has been forecasted by Indian Government that in the financial year 2016-17, Indian economy would get a hike of 7.1%. The growth in the GDP has made the economy of India the strongest among the G-20 countries, according to the Organisation for Economic Co-operation and Development. Moreover, it is expected by the IMF World Economic Outlook Update; the Indian economy would grow 7.2% during FY 2016-2017 and has the possibility and potential to increase even further, to 7.7% during the year of 2017-18 (Kumaraswamy et al. 2012). On the other hand; an economic survey has declared that a massive growth would be seen in Indian economy, which would be between 6.75% and 7.5% in 2017-18 (Hudson.org. 2017). The consumer confidence rate in India has stand at 136 in the 4th quarter of last year. Neison, the agency of market research has declared that India has gained a good score in the consumer record globally. It values the sentiment of the consumers. The corporate earnings of India are supposed to increase by over 20% in the year 2017-18. The earnings are expected to grow with the support of normalisation of profits. The GDP of the country is also projected to increase by 7.5% over the same period (Boutabba 2014).

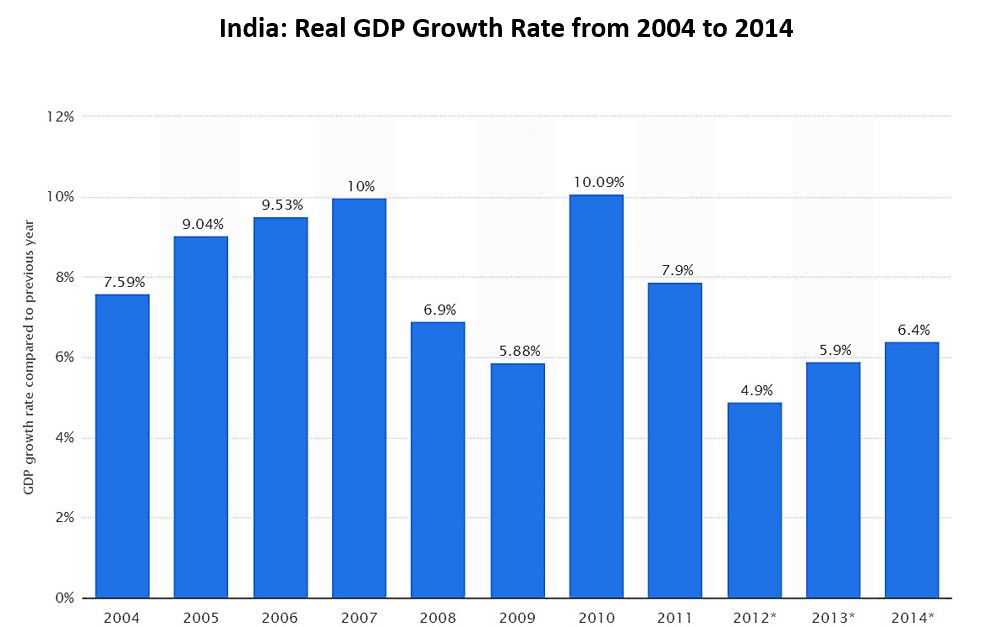

GDP growth rate in the Indian economy:

Figure 4: GDP growth of the Indian economy

(Source: Nagaraj and San, 2017)

In India, the growth rate in GDP refers to the change in the value of goods and services by the Indian Economy, adjusted seasonally. India is the second most populous country, and along with that, the country has the tenth largest economy in the world. Services are the most important and the fastest growing sector of the Indian Economy. Services like Hotels, Trade, Financing, Transport and Communication, real estate and business services, social and personal services account for more than 60% of GDP (Ahluwalia and Little 2012). Besides that, Goldar and Goldar (2016) have commented that the Gross Domestic Product (GDP) in India has grew up to 7% every year in the last quarter of 2016 in October- December. It is been considered as the strongest among the nations enlisted in G-20. Even, the amount of collected tax is also showing an increment of 16.9% in the Net indirect tax. Similarly, the Net direct tax has also been increased up to 10.79%. On the other hand, Lindberg and Jütting (2016) have added that this development is a proof of healthy and spontaneous growth. The amount of income tax return those has been e-filed has grown from 21% to 42% in last financial year. The total amount is 42.1 million in 2016-17 (Ibef.org. 2017).

Lin et al. (2016) have claimed that the corporate earning in India may be grown up to 20% in this financial year. They would get the support especially from banks and automobiles. It is expected that GDP would also be grown up to 7.5% in the same time. On the other hand, Ferreira et al. (2017) have mentioned that India has established its position as in third largest base for start ups. Almost 1400 new start ups have started their journey in 2016. Even, within 2010, the labour force of India would reach 160-170 million. The foreign exchange of this country has reserved US$ 366.781 billion in March 2017. It was only US$ 360 billion in March 2016 (Hudson.org. 2017). This current development in Indian economy has boosted up several M&A activities in the country.

2.3 Explaining the Overview of Foreign Institutional Investment

According to Luong et al. (2017), the Foreign Institutional Investment refers to those investors who prefer to invest in assists of a different country. In other words, Foreign Institutional Investor means an establishment or an institution outside India proposes to make investments in the security of India (Buchanan et al. 2012). This term is commonly used for the companies outside India making their contributions to the financial markets of India. The foreign institutional investors are any significant investor that operates and does business in a country rather than the one in which the investment instrument gets purchased. The countries with developing economies like India have the highest volume of foreign institutional investment. These investments provide the economies with higher growth potential than maturity. This is a huge reason why the investors are commonly found aiding Indian economy, registered with the Securities and Exchange board of India. These investors mainly invest in such nations where their organizations have already been established. They are the most important factor of the economic scenario of any country. Chen et al. (2017) have argued that a well established and strong financial market is the ultimate element that makes a country developed from the economic perspective. It is being considered as the economic system that supplies the required financial inputs for producing goods as well as services. In return they promote the living standard and the well being of the people of the country. Therefore, making India financially strong should be the first priority of its government. However, from the perspective of emerging it is being considered that India is rapidly growing and keeps a constantly developing economic scenario. Several foreign investments like FDI and FIIs are there to leverage the development.

Breaking down of Foreign institutional investors:

Figure 5: Examples of Foreign Institutional Investments

(Source: Solomon and Aggarwal, 2017)

FIIs include hedge funds, companies, insurance, mutual funds and pension funds. Selvam and Raman (2017) have commented that FII is being considered as a major investor that performs business in such a country from where the investment instruments have not been purchased. FIIs take position in an overseas economic market on the behalf of its own country where they are being registered. Mishra and Zaveri (2017) have stated that developing markets provide major potential for the growth in upcoming future. This opportunity has attracted several investors from United States as well as other countries. Multiple investments are there those have made as FII. Especially three investments are there those have been referred to ‘hot money’. Basically, these investments have always represents the substantial sums which could be withdrawn any time from the market.

FII in India:

Hiremath and Kattuman (2017) have opined that countries with emerging economy have the maximum volume of foreign institutional investments. This kind of economy produces the maximum potential of growth to the investors than a matured economy. This is the main reason for which these investors prefer to invest in India. All of them have registered to the Securities and Exchange Board of India for participating in this market. Jalota (2017) has provided examples in this support as a company of mutual fund may find opportunity in Indian market and that is why the company may invest here. However, all Foreign Institutional Investors are allowed to invest in Indian Economy as well as in the primary and secondary capital markets of India only through the portfolio investment scheme of the country Through this scheme; the foreign institutional investors are allowed to purchase debentures and shares of companies of India on the standard public exchanges. However, this project also comes with a set of regulations as well. This law establishes a ceiling for all and every foreign institutional investor to have a maximum investment amount of 24% of the paid-up capital of the investment that the Indian companies receive. Moreover, through board approval and the passing of the special resolution, this maximum investment limit can be increased from 24%. However, for the investments in the public sector banks, the ceiling of maximum investment limit gets reduced to 20% (Srikanth and Kishore 2012). These ceilings and limits for all foreign institutional investors and investments are monitored by the Reserve Bank of India on a daily compliance. The compliance is checked through the implementation of the cut-off points 2% below the maximum possible amount of investment. In this way before the allowance of the final 2% to be invested, the Indian company gets a chance to caution before receiving the investment. They could be able to buy the equity on the public exchange of India as well as would take lo

ng position to the high growth stock. The domestic private investors should also be benefitted from this approach. Actually, it has been noticed that these investors may not get the chance to be registered with SEBI. Rather they would get the opportunity to invest in several mutual funds should take part in potentially high growth.

2.4 Analyzing the Effect of Current Changes in the Indian Economy to Attract FII

As per the above discussion, it is understandable that In spite of being counted in the list of third world country, still the nation is developing very fast. Especially, the foreign investors are discovering India as one of the best market to invest in. Mohanasundaram and Karthikeyan (2017) have opined that the best proof of this development is the high increment of merger and acquisition rate in the country. Ahmad and Khan (2017) have emphasized on the recent change of Indian attitude that the country is showing more interests on business activities. It has inspired the foreign investors more to invest in this country.

Impact of GST on Indian economy:

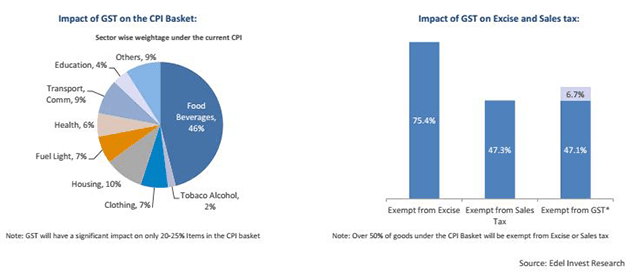

Figure 6: Impact of GST on Indian economy

(Source: Sinha, 2017)

The biggest Tax reform in India named GST was entirely formed on only one notion, “One nation, one market, one tax”. The introduction and the implementation of this GST in the Indian market have been very much successful and profitable for the Indian Economy. The single biggest indirect tax regime, named GST kicked into force while dismantling all the other individual taxes that varied with states and trades. With a single rollout, the stroke of GST converted the country in a unified market of 1.3 billion citizens. Through doing away with all the state and local taxes along with the internal tariff barriers, the $2.4-trillion economy is trying to transform itself through a unified GST (Cnossen 2012). The GST has the potential to widen the economy of India and regain the momentum through economic reformation programs. However, there are also risks of disruption due to the rushed transition which may not act in favour of the interests of the country. However, the impact of GST on the Indian economy, whether good or bad, ultimately relies on the application of the Government. It is widely accepted by the manufacturers and traders that the implementation of GST would to a large extent simplify the taxes regarding their businesses (Sehrawat and Dhanda 2015). With fewer tax filings, easy bookkeeping, transparent rules, the lesser need of payment by the consumers, and above all through the plugging of revenue leaks, the Government would generate more revenues. As stated by Sinha (2017), India is in the top list for most of the foreign investors. The latest change in Indian economy is all about the inclusion of GST (Goods and Service Tax). It has made India more attractive to the foreign investors. Strong macros, controlled economic deficit and stable currency are the major components those have made the country developed in comparison to other emerging nations. Srinivas (2016) has argued that it is not all about the comparison, it actually shows the probability of foreign investments. If it should only be considered from this perspective, then the amount of Rs 31,778 crore should be mentioned as the investment from Foreign Portfolio Investor (FPI). It results an inflow of Rs 27,055 crore last year (Ibef.org. 2017). It is expected from the implementation of GST, as long-term benefits, the implementation of GST would not just refer to the lower rate of taxes, but it would also minimise the tax slabs. However, it can be seen that the impact of GST on the indicators regarding the macroeconomic situations is likely to be quite confident (Garg 2014). Through the elimination of the cascading effect, the Inflation is most liable to be reduced. Due to an extended tax net, the government is very much likely to grow more revenue from the taxes. Moreover, along with the increment of the FDI or the Foreign Direct Investment, the exports will increase as well.

Foreign investors are interested in domestic stock. Almost 269 new FPIs have registered their names with Security and Exchange Board of India (SEBI), the regulator of capital markets in the month of April (Hudson.org. 2017). It is obviously an indication for the growth story of Indian economy. FPIs are willing to invest here in Indian market as they consider it as better destinations for investments. Thus, the total number of registered FPIs in SEBI is almost 4580. Ahmad et al. (2016) have stated that Indian Government has taken a remarkable step in reducing the amount of black money. It is definitely a golden opportunity by which India can get more developed financial circumstances.

Effect of demonetization in Indian economy:

Nagaraj and San (2017) have narrated that Indian government has announced to ban the old notes of 500 and 1000 in 8th November 2016. it was an attempt regarding demonetization of higher level denomination regarding those bank notes. It was all about to take control over the black money as well as to stop the growth of fake notes of Indian currency. Due to this strategy almost 86% of currency has been nullified as they were being aimed to be converted to the white money through the cash supply of black market. Goldar and Goldar (2016) have commented that It was a part of Indian economy and very common strategy applied by a large part of rich Indian people. However, apparently, this phase was mismanaged, but the micro level has got its effect. Several illegal activities such as financing in terrorism and false auditing of property and cash have been controlled by it.

2.5 Evaluating the Impact of FII on the Economy of India Emphasizing on Indian Stock Market

The definition of FII has been discussed earlier as it is an institution that has been organized outside India to invest in the security market of India. Lindberg and Jütting (2016) have added that FII Includes mutual funds, pension funds, assess management business organization, investment trust, manager of institutional portfolio, bank, Nominee Company, university funds, charitable secretaries, endowments, charitable trusts, foundations, trustee or the holder of power of attorney established or incorporate outside India. Lin et al. (2016) have stated that FII can invest own funds of them and on behalf of the foreign clients as well.

Impact of FII on Indian economy:

FII leads an appreciation of the currency. It needs to maintain the account with the Reserve Bank of India and all the transactions should be noted there. Ferreira et al. (2017) have suggested that strong flow of FII can include lot of funds in stock market. Large amount of foreign investment may create huge demand of Indian rupee. Therefore, excess liquidity can result inflation. On the other hand, it brings an enhancement in equity capital’s flow. Luong et al. (2017) have opined that not only about the economic development, it helps to improve the corporate governance as well. After analyzing the opinions of these scholars it can be said that FII makes profit for the entire Indian financial structure.

Impact of FII on Indian Stock Market:

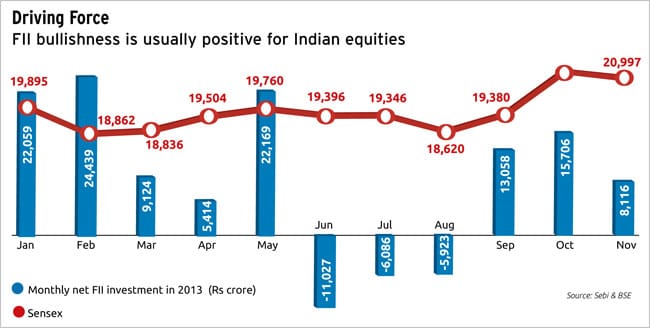

Figure 7: Overview of Indian Stock Market

(Source: Chen et al. 2017)

According to Solomon and Aggarwal (2017), FII contributes specifically among the companies those are being included in Sensex (Sensitivity Index)of Stock Exchange in Bombay. It has been noticed that the overseas investors are more interested to invest in those business organization which have higher share volume holds by the general people. There has an inverse relation between foreign investments and promoters’ holdings. Foreign investors generally prefer those firms which have not much of family shareholders. Selvam and Raman (2017) have added that among the investment decisions of foreign investors can be influenced by per share earnings and returns of the shares.

Mishra and Zaveri (2017) have suggested that a thorough review of stock exchange is highly required now. Even the liquidity position should also be improved. In a brief it can be said that FII has enlarged the stock market of India from both the breadth and depth. FIIs play the most important role to expand the security businesses. Hiremath and Kattuman (2017) have commented that most of the policies of FIIs have focused on the fundamental of share and the efficient share pricing is responsible for it. It is such an effective in Indian market as whenever these investors plan to withdraw money from the market, the domestic investors get afraid and withdraw their own money also.

2.6 Assessing the Advantages and Disadvantages of FII while investing in India

The above discussion has produced a positive opinion about FII. Yet, it is not possible that no negative feature has been found in FII. According to Jalota (2017), Foreign Institutional Investment has both the positive and negative impacts on Indian economy. In spite of both the effects, the economists in India have suggested to avail its advantages because it has brought a remarkable change in Indian economy. However, positive and negative both the features have been mentioned as well as discussed as follows:

Advantages of FII:

Mohanasundaram and Karthikeyan (2017) have added that Foreign Institutional Investments is the key that enhances the flow in equity capital. Basically, it mostly prefers equity rather than the debt in the asset structure of them. Opening up the economy to the Foreign Institutional Investment should be in a line with its accepted preference for the non-debt created foreign inflow over the foreign debt. Increased flow of equity capital would be helpful to increase and for developing the capital structure. Even, they should also influence to contribute in the identification of investment gap. On the other hand, Ahmad and Khan (2017) have argued that not only about to this enhancement, FII is beneficial for managing the financial uncertainty as well as to control the fiscal risks too.

Other than that, FII is profitable for financial innovation also. Sinha (2017) has included here that it further helps in developing the hedging instruments as well. It enhances competitions in the financial market and develops the alignment in asset prices for the fundamentals. Other than that, making improvement in capital markets is another advantage of FII. Sinha (2017) has commented that FII can work as a professional body for managing the assets. On the other hand, the role of financial analyst may also be served by FII. The development of equity market also helps to develop the economy, therefore contribution of FII cannot deny anyway.

Apart from all the above mentioned advantages, FII helps India in the improvement of its corporate governance also. Srinivas (2016) has stated that FII includes some professional people specialist in asset management and financial analysis. They have better understanding about the operations of firms and improvement of corporate governance. However, it can be said that arrival of FII has changed the financial situation from many aspects and it is expected that India would be more benefitted in future. In spite of such advantages several disadvantages are also there. All the disadvantages have described as follows.

According to Ahmad et al. (2016), inflation is the major problem which can be raised due to FII. Huge amount of funds that have been flown in the country creates demand of currency. RBI pumps the amount into rupee and therefore the demand increases. Small investors may face problems in it. FII usually earn profit due to the investment in the financial stock market of emerging countries. If FII would be high, therefore they would be able to invest large amount of money in the stock market of the country.

Nagaraj and San (2017) have stated that export sector is usually being affected through FII. The export industry becomes uncompetitive and therefore the productivity has reduced. ‘Hot-money’ should be mentioned as another problem of FIIs. This term indicates to the meaning of fund. This fund is being controlled by the investors especially those are seeking for short-term return. Goldar and Goldar (2016) have commented that the market has been scanned by these investors on a short-term basis. It provides high rates of interests in investment opportunities. Hot money may have economic repercussions on the banks and countries. If money would be injected into a nation, therefore the exchange rate of the country may gain strong money. On the other hand, if the exchange rate may loss, therefore the money may be weakens. Even, if money would be withdrawn therefore a shortage may appear.

2.7 Gaps in literature

The researcher has gone through several scholarly articles to gather data about the current impact of FII in Indian economy. It has been seen that this is a very common topic for research and multiple researchers are there those have already made projects on it. In spite of that, a major gap has been identified there in the researches of earlier scholars. Most of the scholars have mainly focused on the definition of FII and the reason for what the foreign investors prefer to invest in India.

Other than that, for discussing on the topic, secondary data have been gathered as well as analyzed. For example, V. Aditya Srinivasin hisarticle Indian Capital Market – Impact of FII on Indian Stock Market in the journal namely Indian journal of Science and Technology has discussed about the importance of FII money in the stock market of India. Thus, Srinivas (2016) has commented that a safety net is required by which the investors may get a proper understanding of FII and they may get protection from the false investment. However, no primary data in this regard has been collected. Therefore, this research would focus to gather both the secondary and primary data as the authenticity may be enhanced.

2.8 Conceptual Framework

Figure 8: Conceptual Framework

(Source: Created by author)

2.9 Summary

This chapter has provided a complete knowledge of the theoretical base of Foreign Institutional Investment and its importance in Indian economy. Other than that, an elaborate discussion on the current development of Indian economic scenario has made this chapter more acceptable and significant for this research project. The discussion has included the opinions of several scholars. After analyzing all the opinions, the researcher has identified the gap based on which the research work can be composed. This chapter has mentioned about GST which is the hottest topic of Indian economy and the researcher has explained that implementation of GST has changed the economy remarkably. It works as a key element to boost up the development of this economy.

Chapter 3: Research Methodology

3.1 Introduction

As per the title of the chapter, this part of the dissertation is all about the methodology for this project. The researcher would outline the research method through which the overall project should be carried on further. This chapter would discuss about the data collection process, techniques for collecting the data and the instrument as well. However, the ethical assurance would also be provided by the researcher as no confidentiality would be broken up. Other than that, research philosophy, approach and design have also be discussed here. Besides that, a time table has been provided here which would depict the time that has been taken by the researcher for every activity.

3.2 Outline of Chosen Methods

Vaioleti (2016) has commented that methodology is being considered as the systematic and theoretical analysis of the study as well as the principles associated with the knowledge. It basically incorporates the ideas like paradigm, qualitative and quantitative techniques, phases and theoretical models. In this particular research, the researcher would choose the post positivism philosophy, descriptive research design and deductive approach. In addition, proper justification has also been provided by the researcher in support of choosing research approach, philosophy and design. Both the primary and secondary data have been collected for this research work. The data collection sources and sample size both have mentioned here by the researcher.

3.3 Research Philosophy

According to Silverman (2016), research philosophy is known as the belief depending on which specific phenomenon has been analyzed, collected as well as used. This is true that the selection of a specific philosophy effects the practical implication of the study. research philosophy can be defined as a belief regarding the way in which the data about a phenomenon can be collected. Three different types of research philosophies are there. They are realism, positivism and interpretivism. Realism research philosophy is all about the idea derived independently from the human mind. On the other hand, Humphries (2017) has commented that while discussing the interpretivism research philosophy the idea is mainly derived from the subjective phenomena as well as the real invention is easily understandable. Other than that, when the phenomenon would be isolated and observation would be reasonable, then it can be called as the positivism research philosophy. Post-positivism philosophy is an updated version of positivism philosophy.

3.3.1 Justification of Choosing This Philosophy

As this research is on the impact of FII on Indian stock exchange, the researcher has chosen the post-positivism philosophy. the reason of choosing this philosophy is that the knowledge about the matter have been generated based on the positive data. This research work has been conducted based on the facts of earlier research papers. Therefore, post-positivism research philosophy is most suitable for it. It is really helpful for analyzing the data as it consists a historical tradition which can define the knowledge demands supported with the unscientific research (Kurinczuk et al. 2016). On the other side, the realism research philosophy has not been chosen as most of the data would be analyzed through a scientific research. Other than that, some interpretations should be analyzed through the social constructions such as consciousness, shared meanings and language. Marais and Pienaar-Marais (2016) have opined that the selection of post-positivism research philosophy promotes the objectivity idea towards confirmation and falsification of the specific position. Therefore, the researcher could start with the theory as well as earlier facts and would formulate a hypothesis and even the data collection would also be done in accordance to it.

3.4 Research Approach

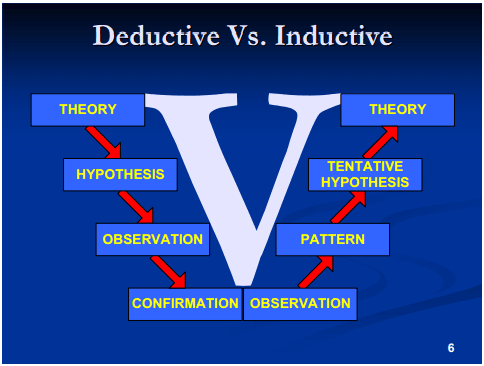

Figure 9: Research approaches

(Source: Patino et al. 2016)

Wiek and Lang (2016) have discussed that the research approach can be divided into two types, they are inductive and deductive. In deductive approach, the conclusion would be made based on the agreed and measurable facts. Besides, establishment and building of facts for the approach creates the deductive arguments. This approach follows a particular sequence that is to start from the general principles by which the researcher can made the deduction. After that it should be carried out through the conclusion where the statement would be linked up with the specific situation. On the other hand, the inductive approach demands new facts from the observation. The, researcher has chosen the deductive approach for this project.

3.4.1 Justification of Choosing this Approach

As stated by Mackey and Gass (2015), deductive approach should establish the role, for defining the existing theory as to develop the hypothesis as well as the variable choices. Inductive research has not been chosen for this project as the enquiry areas in this research has been composed on the basis of the representation of hypothesis and the existing theory. The researcher has started collecting existing models, theories as well as the background data related to the topic. therefore, the deductive approach would be the most suitable for this project. With the help of existing data, the researcher becomes enable to make the research questions. However, the responses of these questions should be retrieved along with the surveys and questionnaires, which may end up to a positive conclusion.

3.5 Research Design

Figure 10: Research design

(Source: Taylor et al. 2015)

Research design is being considered as the set of processes as well as methods which should be used to analyze and collect the specified variables for research problem. Four different types of research designs are there. They are: Descriptive, confirmatory, explanatory and exploratory. Panneerselvam (2014) has opined that the exploratory research design is needed when the when the researcher may make a brief focus on a familiar as well as insight investigation procedure. Other than that, the explanatory research design can be analyzed as an attempt to explain the cause and effect of that specific research. Besides that, the descriptive research design explores and explains while including some additional information about a particular topic.

3.5.1 Justification of Choosing this Research Design

The researcher has chosen the descriptive research design for completing this project. Silverman (2016) has mentioned that descriptive design is basically a conclusive design that can set the objectives for describing the characteristics and opinions of the respondents. In addition, the descriptive design contains a prior formulation for analyzing particular questions as well as the hypothesis of the research. Kao et al. (2016) have stated that descriptive research should be defined in large samples. Other than that, the confirmatory research has not been chosen by the researcher as the probability of result should be based on coincident. On the other hand, for the explanatory research design, the attempt should contain a good outcome. Yet, it would not be possible in this research. Besides that, the exploratory design has not been chosen as it needs a flexible approach for understanding the impact of FII on Indian stock market. Even, this would be very hard to measure. Therefore, after assessing all the aspects, it can be said that descriptive design would be the most suitable for this research paper.

3.6 Research Strategy

Smith (2015) has mentioned about two strategies for conducting a project and they are qualitative and quantitative research strategies. The quantitative research strategy helps in quantifying the behaviour, attitudes as well as opinions with other variables. Other than that, the qualitative research strategy provides a core understanding about the opinions and motivations as well as the reason of the research. Therefore, both the strategies have been used here to complete this research work.

3.7 Choice of Selected Research

The choices of this project are survey and interview both. It is related to the deductive approach. The survey method is quite frequent to be used in responses of the questions like ‘how often’, ‘do you’, ‘what’, ‘why’ and ‘how far’. Apart from that, the questions are easy to answer and comparison can be made easily. A reliable manner has been followed while conducting this research, thus it provides an effective understanding as well as explanation of the phenomena along with the vast research. In one side, survey provides an idea about the opinions and attitudes of the respondents, on the other side interview includes a proper knowledge about the detail of the fact. Therefore, amalgamation of both the choices have made the research paper more accurate.

3.8 Data Collection Technique

As stated by Bauer (2014), two different types of data collection techniques are there, they are primary and secondary. Both of them have been used in this project. The qualitative and quantitative methods are being connected to the primary data. Survey questionnaire would be used to collect the quantitative primary data. Besides that, On the other hand, Tuohy et al. (2013) have opined that the secondary data is all about the collection of earlier facts and theories. Therefore, the researcher has gone through several books, journals and visited multiple websites for gathering the secondary data. In this research, the secondary data have been used mainly in the literature review part. Though it has been linked up with the primary data as well. Basically, secondary data could be accessed easily and the collection process is not much hazardous.

3.8.1 Types of Used Survey

The researcher has chosen a face to face survey process for collecting the quantitative primary data for this project. The sheets of pre-set questionnaires have been distributed among the respondents and they are being asked to fill up in accordance to their opinions.

3.8.2 Types of Interview

The researcher has arranged the telephonic interviews with the respondents to collect the primary qualitative data.

3.9 Sampling and Population Method

According to Silverman (2016), population can be defined as an combination of elements those share some common features regarding the issues of the research. On the other hand, sampling is known as where the overall procedure is needed to select the group of representative from the assessed population. It also defines the frame of population by identifying the research structure with the measurable events.

3.9.1 Types of Sampling

As stated by Vaioleti (2016), two types of sampling are there, they are non-probability and probability. Both of them are associated with the primary data collection. The probability sampling is suitable for the interview sessions where the researcher can get more accurate data rather than the survey method. In response of survey, there is high chance to produce false replies as the respondents are being randomly chosen by the researcher. Thus, probability sampling is the best way for it. Hence, for this research the researcher has selected both the probability and non-probability sampling.

3.9.2 Choice of Sampling

The reason behind choosing both the sampling in this project as survey and interview both have to be conducted by the researcher. Humphries (2017) has discussed that in large population it is quite difficult to identify the each member of the population. Therefore probability sampling is suitable for the survey respondents. On the other hand, as the members of interview could be identified by the researcher so non-probability sampling would be the best for it.

3.9.3 Chosen Sample Size

The researcher while conducting the project based on the impact of FII on Indian stock market would select 100 respondents randomly. The responses of these people would be analyzed by quantitative method. Among the 100 respondents, the researcher would choose 50 by applying the probability technique. On the other hand, 2 representatives of SEBI would be chosen for completing the interview sessions. These responses would be analyzed through qualitative method. Therefore total sample size would be 50 and 2.

3.9.4 Questionnaire Selection

The questionnaire has been composed based on the research objectives those have been mentioned in the first chapter of the project. for both the quantitative and qualitative questionnaires the researcher would try to focus on the impact of FII on the Indian stock market. The survey questionnaire would be close ended whereas the qualitative questions would be open ended.

3.9.5 Questionnaire Design

The questionnaire would be designed based on the researcher’s perspective. Basically, it depends on the way in which the researcher wants to conduct the survey. Kurinczuk et al. (2016) have stated that the researcher should ask questions related to the topic. The researcher would put near about 15 questions in survey sheets and 5 questions would be scheduled for the qualitative part. The close ended quantitative questions would be answered by choosing the options like ‘strongly agreed’, ‘highly satisfied’, ‘neutral’, ‘strongly disagreed’, ‘highly dissatisfied’, ‘agreed’ and ‘disagreed’. Other than that, some of the questions may also be answered by ‘yes’ or ‘no’ options. On the other hand, the qualitative questionnaire would be answered in paragraph form.

3.10 Data Analysis Process

The quantitative data would be analyzed in MS Excel format. However, the findings of both quantitative and qualitative would be written on MS Word document.

3.11 Reliability and Validity

According to Marais and Pienaar-Marais (2016), reliability seems to be the extent in which the consistent result would be produced. Repeated practice and the same result for each of the time may maximize the reliability of the outcome. On the other hand, validity is basically concerned about if the result is performing precisely or not.

3.12 Limitations on Research Methodology

While conducting this research work, the researcher has faced some issues or limitations. Elaborate research has been done by the researcher to gather the information or data. For the survey, the researcher was decided to target limited number of people as the respondents. However, after starting the work the researcher has realized that the survey sheets should be distributed at least among 100 people. Thus, 50 can be selected.

3.13 Ethical Consideration

Some ethical norms should be obeyed by the researcher while conducting a project. Patino et al. (2016) have discussed that the respondents can withdraw their participation any time from the survey and the researcher cannot force them anyhow. Even, the personal information of respondents would not be disclosed. The researcher has obeyed all the ethical norms. No privacy of the respondents have been publicised. No personal data of the respondents have been used. The researcher has followed the Data Protection Act 1998 with full respect. Even, the researcher has not forced anyone to take part in this project.

3.14 Time Table

| Activities | 1st to 3rd week | 4th to 6th week | 7th to 9th week | 10th to 12th week | 13th to 15th week | 16th to 18th week | 19th to 21st week | 22nd to 24th week |

| Choosing the research topic | Y | |||||||

| Background of the project | Y | |||||||

| Determining the aims, objectives and Questions of the research | Y | |||||||

| Literature review | Y | Y | ||||||

| Determining the methodology | Y | Y | ||||||

| Analyzing the surveys | Y | |||||||

| Scheduling the Time Plan | Y | |||||||

| Findings for the research | Y | |||||||

| Analyzing the collected Data | Y | |||||||

| Concluding the overall research | Y | |||||||

| Self Reflection | Y | |||||||

| Submitting the project | Y |

Table 1: Gantt chart

(Source: Created by author)

3.15 Summary

Research methodology is such a way that show the route by which the project can be carried on. Thus, this chapter includes a special value in every dissertation. There researcher has discussed about the philosophy, approach and design here along with the reason of the selection. Other than that, a basic conception about these three have also been narrated here in this chapter. Apart from that, data collection method, data analysis techniques, ethical consideration and limitation of methodology have also been narrated here. The researcher has used survey questionnaire and conducted interviews to collect the primary data. Thus, this research becomes more authentic and fact-full.

Chapter 4: Data Analysis and Findings

4.1 Introduction

This is one of the most important chapters in this research work. The collected data here would analyze the predicted visions of the research. This chapter would determine that the researcher has tried with full effort to frame out the derivatives by primary data. In addition, this part of the research would identify the questionnaires which are influenced by the fact of impact of Foreign Institutional Investment on Indian stock market. The researcher has distributed the survey questionnaire among the Indian people aged between 20 to 60. These respondents are the business operators in Indian stock market. As the primary research work needs the involvement of respondents, the researcher has distributed the survey questionnaires among the people. The quantitative data have been documented in a tabular format whereas the qualitative data have been noted in a paragraph style. In addition, the research objectives would also be framed in with the study in a better way through this analysis part.

4.2 Quantitative Data Analysis (Traders of Indian Stock Market)

The researcher has distributed the survey questionnaire randomly among 100 traders who deals in Indian stock market. Among them 50 responses have been considered here to carry on this research project. 10 close ended questions have been asked to the people those are being already engaged in trading in the stock market. The options have been provided such as ‘yes’, ‘no’ or ‘agreed’, ‘disagreed’ and the respondents need to select the answers of their own choices from there. The involvement of theses respondents were completely spontaneous. No pressurization has been created on them. Even, no personal question has been asked and it has been ensured that the respondents can avoid any question by not providing its answer.

In addition, the researcher has counted the mean, median, mode and standard deviation against each of the answer. The data has been showed in additional charts. Two demographic questions are there those have been asked to the respondents to get an initial information about them. The data have been showed in tabular format followed by the chart. After the completion of chart against each of the data, the researcher has added two different points, namely ‘findings’ and ‘analysis’. In the finding part, the researcher has added the numbers or amounts which have been gathered by the responses. The analytical part contains the narration and the assessment which has been done by following the flow of responses. While analyzing the quantitative data, the researcher has linked up them with the literature review part as well. It enhances the validity as well as the authenticity of the data.

Q1. What is your gender?

| Options | Responses | Total Respondents | % of Respondents |

| Male | 27 | 50 | 54% |

| Female | 23 | 50 | 46% |

Table 2: Gender of the respondents

| Mean | 1.46 |

| Median | 1 |

| Mode | 1 |

| Standard Deviation | 0.503457 |

![Figure 11: Gender of the respondents

[SAMPLE DISSERTATION]](https://onlineassignmenthelp.org/wp-content/uploads/2024/12/Screenshot-2024-12-04-at-4.33.24 AM-1024x593.png)

Figure 11: Gender of the respondents

Findings

Among the respondents there were 27 male and 23 female. Therefore, the percentages are like 54 and 46 respectively.

Analysis

While analysing this amount, two assumptions can be developed. First of all, there could be more male investors or trader operators in Indian stock market. Secondly, the female respondents probably were not much interested in taking part in this survey. Whatever the reason is, ultimately it is being showed that the number of male investors is more than the female investors in Indian stock market. This is a general demographic question, thus it has no need to relate to the literature review part.

Q2. Which age group do you belong to?

| Options | Responses | Total Respondents | % of Respondents |

| 20 to 30 | 12 | 50 | 24% |

| 31 to 40 | 20 | 50 | 40% |

| 41 to 50 | 10 | 50 | 20% |

| 51 to 60 | 8 | 50 | 16% |

Table 3: Age group of the respondents

| Mean | 2.28 |

| Median | 2 |

| Mode | 2 |

| Standard Deviation | 1.01096 |

Figure 12: Age group of the respondents

Findings

12 people were between the age group of 20 to 30. On the other hand, 20 respondents were there those belong to the age group of 31 to 40. 10 respondents among the 50 were there those belong to the age group of 41 to 50. Only 8 people were there those are aged between 51 to 60.

Analysis

This is also a demographic question. It has been asked to ensure the ages of participating people. The ratio has proved that most of the young people are interested in the business of stock market. Though the middle aged people are not in the backbench. A good number of this people have joined this survey as well. Yet, most of the interest may be grown among the people of aged between 31 to 40. This is again a demographic question which is related to the age group of the respondents. Thus, no linking up with the literature review part is needed further.

Q3. Are you involved in other business except the sharing brokering?

| Options | Responses | Total Respondents | % of Respondents |

| Yes | 26 | 50 | 52% |

| No | 24 | 50 | 48% |

Table 4: Businesses of the respondents

| Mean | 1.48 |

| Median | 1 |

| Mode | 1 |

| Standard Deviation | 0.504672 |

Figure 13: Businesses of the respondents

Findings

In response to this question, 26 people have agreed positively. It means almost 52% people are being involved in this business. On the other hand, 24 out of 50 respondents have disagreed that they are being involved in other business apart from the share market. Therefore, it can be said that 48% of the rest of the people are doing this business with full of dedication.

Analysis

While analyzing this data, a remarkable positive side of Indian economy has been explored. It offers several chances to the people by which they would be enabled to earn more. From the above findings, this facts has been proved. It shows that a large group of people have mentioned that they are also involved in other businesses rather than only investing ink share market. It means they are getting multiple sources of increasing their earnings. On the other hand, the number of people those are dedicatedly involved in stock market is not at all low. Therefore, it again proves that from the stock market these people are earning sufficient by which they can maintain their lifestyles. Improvement in people’s earning is the source on the other hand to develop the economic scenario of the country. Therefore, by analysing this fact, it can be said that the financial framework of this country is being developing gradually. By this question, the researcher wanted to ensure the status of the respondents. Thus, it needs not to be linked up with the literature review part.

Q4. How long do you have the experience in this business?

| Options | Responses | Total Respondents | % of Respondents |

| More than 10 years | 16 | 50 | 32% |

| 5 to 10 years | 14 | 50 | 28% |

| 1 to 5 years | 12 | 50 | 24% |

| Less than 1 year | 8 | 50 | 16% |

Table 5: Experiences of the respondents in share market

| Mean | 2.24 |

| Median | 2 |

| Mode | 1 |

| Standard Deviation | 1.079682 |

Figure 14: Experiences of the respondents in share market

Findings

In response to this question, 16 people (32%) have informed that they are operating business in this field for more than 16 years. 14 people (28%) have informed that they have 5 to 10 years of experiences in this field. On the other hand, 24% (12) of people have informed that they are working here for 1 to 5 years. 8 people (16%) were also there those are completely new there and work less than 1 year.

Analysis

The above mentioned data is again showing that the scenario of Indian stock market is quite impressive and it is being developing continuously. The findings indicates that 16 people out of 50 have operating there business for more than 10 years. By this fact it can be easily assumed that it is a profitable sector and that is why people prefer to stay here in long term. On the other hand, the 8 people out of 50 have shown interest in this field and that is why they are willing to invest here. Maybe they are new in this field, but obviously they are adding a portion of contribution in Indian economy and its development. It is as same to the previous question. Hence, linking up with the literature has been avoided here too.

Q5. Among which category of investors would you be considered?

| Options | Responses | Total Respondents | % of Respondents |

| Retail | 4 | 50 | 8% |

| High Net worth Individual | 10 | 50 | 20% |

| NRIs | 12 | 50 | 24% |

| Indian corporate | 5 | 50 | 10% |

| Foreign institutions | 13 | 50 | 26% |

| Banks, MFs, Insurance companies or other financial institutions | 6 | 50 | 12% |

Table 6: Investment category of the respondents

| Mean | 3.62 |

| Median | 3 |

| Mode | 5 |

| Standard Deviation | 1.550378 |

Figure 14: Investment category of the respondents

Findings

Most of the foreign investments have been noticed here. Thus the number is 13 out of 50. On the other hand, NRIs are also investing lump sum in this market. therefore, the responses have become 12. Other than that, high net has been chosen by 10 respondents. Banks, insurance corporations, mutual funds and other financial organizations have been chosen by 6 respondents. Only 5 people have selected the Indian corporation.

Analysis

While analyzing this data, the researcher has identified that Foreign Institutional Investment has huge contribution in the stock market of the country. Even, it has also been invested by the NRI funding as well. Yet, the investors of banks and Indian corporate categories did not show much interest to join this survey. Though this is also a question related to the present status of the investors, still this question also provides an idea about the investment sector of India. Therefore, it can be linked up with the section where the researcher has provided a brief discussion about the Indian stock market.

Q6. What is the income range you fall in from your investment?

| Options | Responses | Total Respondents | % of Respondents |

| Up to Rs 1 lac | 4 | 50 | 8% |

| 1 lac 1 Rs to 5 lac | 10 | 50 | 20% |

| 5 lac 1 Rs to 10 lac | 15 | 50 | 30% |

| 10 lac 1 Rs to 15 lac | 9 | 50 | 18% |

| 15 lac 1 Rs to 25 lac | 7 | 50 | 14% |

| More than 25 lac | 5 | 50 | 10% |

Table 7: Investment amounts of the respondents

| Mean | 3.4 |

| Median | 3 |

| Mode | 3 |

| Standard Deviation | 1.428571 |

Figure 15: Income range of the respondents

Findings

4 people were there those income was not more than 1 lac in India currency. 10 respondents have disclosed that they earn within Rs 5 lac. 15 people were there those have earned between 5 lac to 10 lac. 9 respondents have informed that their income is between Rs 10 lac to Rs 15 lac. 7 respondents’ earning was within Rs. 25 lacs. Besides that, 5 peopel have earned more than Rs. 5 lac.

Analysis

This amount is reflecting that the investors here are quite successful and they are earning well enough every year. Therefore, it again proves that the researcher was right that this industry is continuously growing. In fact this is one of the main reason for what the funds of NRIs or FIIs are showing so much of interests to invest in this nation. Moreover, by analyzing the earning rate of the investors, it can be said that the Indian stock market has remarkable contribution in the development of Indian economy. Other than that, leaving lives by operating businesses in this field would not be a worthless idea as the investors are getting full benefit of it. This question has provided an overall view of the present economic scenario of the country. Even, it touches the stock market to some extent as well. Therefore, this question should also be linked up with the point of narrating the stock market.

Q7. How far do you agree that enormous changes have been occurred in Indian economy?

| Options | Responses | Total Respondents | % of Respondents |

| Strongly agreed | 15 | 50 | 30%% |

| Agreed | 11 | 50 | 22% |

| Neutral | 3 | 50 | 6% |

| Disagreed | 12 | 50 | 24% |

| Strongly disagreed | 9 | 50 | 18% |

Table 8: Responses about the changes in the economic scenario of India

| Mean | 2.78 |

| Median | 2 |

| Mode | 1 |

| Standard Deviation | 1.54246 |

Figure 16: Responses about the changes in the economic scenario of India

Findings

15 out of 50 respondents have strongly agreed that they have identified remarkable changes in the scenario of Indian economy. Apart from that, 11 respondents have supported them. On the other hand, this statement was strongly disagreed by 9 people. More 12 people have informed that they do not find such changes in Indian economy. Rest of 3 respondents have answered neutrally in this question.

Analysis

While analyzing the fact, the researcher has assumed a situation in support of this answer. Probably, those respondents who have denied to agree that several changes have been made in Indian economy, may want to mean that the changes are not adequate or up to mark of their expectations. However, the validity of the assumption would be ensured later on through other questions. Before that, it can be said that as per the responses of the positive respondents a huge change has been occurred in Indian economy. A section is there in the literature review part of the study where the researcher has discussed about the recent changes in Indian economy. Therefore, this part can easily be linked up with this section. It would help the researcher to prove the changes as well.

Q8. How far do you agree that FIIS are responsible for those changes in Indian economy?

| Options | Responses | Total Respondents | % of Respondents |

| Strongly agreed | 16 | 50 | 38% |

| Agreed | 11 | 50 | 22% |

| Neutral | 2 | 50 | 4% |

| Disagreed | 13 | 50 | 26% |

| Strongly disagreed | 8 | 50 | 16% |

Table 9: Responses on the impact of FIIs in these current changes in Indian economy

| Mean | 2.72 |

| Median | 2 |

| Mode | 1 |

| Standard Deviation | 1.539149 |

Figure 17: Responses on the impact of FIIs in these current changes in Indian economy

Findings

16 people have strongly agreed with the viewpoint that FIIs are mainly responsible for theses changes in Indian economy. Other 11 people have agreed this point of view as well. Therefore, almost 60% of people have agreed with the statement. This statement has been disagreed by 13 people. 8 people have strongly disagreed this statement. Thus, almost 42% of npeople have disagreed this view. Rest of 2 (4%) people were neutral in this situation.

Analysis

While analyzing this data, the researcher has become more assure that economy of India has been developed gradually. Therefore, this statement has again proved that the earlier statement was also correct. It can be possible that the disagreed people are not at all satisfied with the changes. Similar incident has happened here as well. A group of people have denied that FIIs have stimulated the changes in Indian economy. In support of this data, the researcher has assumed two situations. First of all, these people may do not want to give the credit for these changes to the FIIs. Other than that, secondly, they are those people who are not at all satisfied with the changes. However, with the support of massive people, it can be said that FIIs have a huge contribution in the development of Indian economy. From the above mentioned section of literature review part, the researcher would be able to collect fact in support to this question.

Q9. How far do you agree that FIIs would really be helpful for Indian economy despite of all the disadvantages?

| Options | Responses | Total Respondents | % of Respondents |

| Strongly agreed | 14 | 50 | 28% |

| Agreed | 13 | 50 | 26% |

| Neutral | 2 | 50 | 4% |

| Disagreed | 10 | 50 | 20% |

| Strongly disagreed | 11 | 50 | 22% |

Table 10: Advantages of FIIs in Indian economy

| Mean | 2.82 |

| Median | 2 |

| Mode | 1 |

| Standard Deviation | 1.573894 |

Figure 18: Advantages of FIIs in Indian economy

Findings

14 people have strongly agreed that in spite of such disadvantages FIIs is helping the Indian economy in its betterment. This statement has again being supported by other 13 people out of 50. 10 people have disagreed the statement, whereas 11 respondents have completely denied this point of view. 2 people have chosen the option ‘neutral’ here.

Analysis

This question is also similar to the above two questions. Therefore, it can be said easily that the Indian economy is growing and FIIs is responsible for that. This is true that some disadvantages are also there in this system. Still it is helpful and suitable for the economic scenarios of developing countries like India. This question would be linked up where the researcher has discussed the advantages and disadvantages of FIIs in literature review.

Q10. Based on the earlier questions, how far do you agree that FIIs are ultimate way to improve the financial scenario of developing countries like India?

| Options | Responses | Total Respondents | % of Respondents |

| Strongly agreed | 15 | 50 | 30% |

| Agreed | 12 | 50 | 24% |

| Neutral | 3 | 50 | 6% |

| Disagreed | 9 | 50 | 18% |

| Strongly disagreed | 11 | 50 | 22% |

Table 11: Influence of FIIs in the economic development of India

| Mean | 2.78 |

| Median | 2 |

| Mode | 1 |

| Standard Deviation | 1.581655 |

Figure 19: Influence of FIIs in the economic development of India

Findings

15 out of 50 respondents have strongly agreed that FIIs is the ultimate way that can improve the economic scenario of India. Therefore, 30% of the respondents have chosen this viewpoint. In addition, more 12 people have also supported this statement. It seems more 24% of people also believe that fact. Other than that, 9 people have completely disagreed this statement, whereas 11 people have strongly denied that. Therefore, the ratio has stood by 18% and 22% respectively. 3 people have chosen the ‘neutral’ option while responding in this question.

Analysis

The researcher has also agreed that several loopholes can be found in the system of FIIS. In spite of such flaws, this system is appropriate and mostly needed for the development of country’s economy. However, while analyzing all these data, one thing has been noticed that all of them are indicating two facts. One of them is about the development of Indian economy and the second one is about to the involvement of FIIs in the development of Indian economy. In literature review part, the researcher has discussed about the importance and impact of FIIs on Indian stock market. This question should be linked up with that part of the dissertation.

4.3 Qualitative Data Analysis (for 2 managers of SEBI)

Qualitative analysis has been dedicated to analyze the opinions of the managers from the Security and Exchange Board of India (SEBI). The researcher has chosen two managers from SEBI. This organization is responsible to protect the interest of investors as well as to ensure the development of them too. That is why, the researcher has decided to involve the managers of SEBI in this project for getting appropriate as well as authentic information in this regard. These responses were also collected from the interested respondents only.

The researcher has assured that these managers were not being forced anyhow. The researcher has conducted a telephonic interview with each of the managers in their convenient times. Apart from that, no personal questions have been asked to the mangers. Most importantly, the researcher has not asked any confidential questions related to the organization. The answers of the questions have been documented in MS word file. Five questions have been asked to the managers and while describing as well as analyzing their answers, some statements of them have been quoted. It increases the authenticity of the project. Even, while analyzing the part it has also been linked up with the literature review part of the dissertation.

Q1. What is the impact of FIIS on the current Indian economy?